Rancho Santa Fe attorney David Peters, known for his bullish tactics, hefty settlements and penchant for high-stakes poker, is now a bankrupt vexatious litigant on the hook for a multi-million-dollar arbitration award to his former partners after embezzling from his Encinitas law firm, court records show.

In 2022, an arbitrator’s ruling found that Peters, founding partner of the now-defunct Peters & Freedman law firm, misappropriated and embezzled millions of dollars in partnership funds, often squandering his ill-gotten earnings at casinos.

Retired Judge William McCurine Jr. awarded more than $15 million to the firm’s other partners, James McCormick, Zachary Smith, Kyle Lakin and Christina DeJardin, all of whom are the founding members of Delphi Law Group in Carlsbad. A Vista Superior Court judge has since issued a tentative ruling on Jan. 19 granting the full arbitration amount, and the award is pending final confirmation.

Peters, 65, now faces myriad personal and professional hardships, such as judicial sanctions, bankruptcy and divorce proceedings, frozen bank accounts, seized real estate holdings, and the recent eviction from his $6.2 million Rancho Santa Fe home.

A federal bankruptcy court ordered the U.S. Marshals Service in late July to use any “reasonable force necessary” to seize Peters’ real properties, including his office space on Calle Magdalena in Encinitas, and deliver them to a bankruptcy trustee, where they will be sold to pay his creditors, including his former partners.

On Sept. 14, the Marshals took possession of Peters’ 7,389-square-foot luxury estate in the gated community of South Pointe Farms, a move that apparently caught the former Super Lawyer by “complete surprise” in his response filing seeking to “immediately restore possession of my domicile of more than 20 years.”

According to a recent filing by the bankruptcy trustee, the Sheriff’s Department arrested and briefly detained Peters on Sept. 22 for misdemeanor criminal trespass after discovering he had broken the French door windows in the master bedroom and unlawfully entered the home. The trustee also reported Peters has broken into the residence on “at least three occasions” since the Marshals took possession of his home.

“I will not afford you or your conduct as legitimate,” Peters wrote in a Sept. 15 email response to the trustee’s attorney after learning his home had been seized. “I will take back possession this evening, access medication, and a medical device. I will sleep and use the residence and file for an emergency motion on Monday.”

Peters, the lone attorney for his new law firm, The Oracle Lawyers, has also been named to California’s vexatious litigant list for repeated baseless and malicious court filings. But despite a landslide of legal woes, Peters told The Coast News he was confident that things would eventually go his way.

“I love the case right now,” Peters said regarding the lawsuit with his former partners shortly after the Marshals took possession of his home. “I’m confident I’m going to win. The arbitration award is specious; it’s just wrong.”

In a Sept. 6 court filing (and in numerous past filings), Peters argued the firm lost its status as a limited liability partnership since the ex-partners mistakenly filed a notice of termination (rather than a notice of dissolution) with the Secretary of State prior to dissolving Peters & Freedman. After realizing the filing error, a judge ordered the reinstatement of the firm’s LLP status with the Secretary of State and State Bar of California, a move that Peters claims was unlawful.

According to Peters, this clerical gaffe was immutable, rendering moot all subsequent rulings related to the dissolution of Peters & Freedman over the past half-decade, including the arbitration award.

“The king is not wearing any clothes,” Peters said. “The whole case has been centered on turning back the clock within an arbitration. Even if erroneously filed, the cancellation of a public document in which third parties included tax entries cannot be corrected, reversed or changed nunc pro tunc (now for then).”

However, multiple judges in state and federal courts repeatedly dismissed this argument as irrelevant and frivolous, with court records showing the case centered around Peters’ fraud and embezzlement.

Bad faith

After dissolving their partnership with Peters & Freedman in 2018, McCormick, Smith, Lakin and DeJardin filed a petition in state court seeking injunctive relief to “preserve and protect” the firm’s assets during arbitration, as previously reported by The Coast News.

The petitioners claimed that Peters was using the firm’s credit cards for cash advances to cover gambling losses and misappropriating millions of dollars in partnership funds.

Two months before his partners filed a petition accusing Peters of financial misconduct and posing a risk to company assets, PokerGO posted a photo on Twitter, now X, of Peters, clad in sunglasses and a ballcap, playing Texas Hold ‘Em for Poker After Dark.

“Can anyone stop Dave Peters? The California attorney is up close to $400K across two ‘Solve for Hollywood’ cash games,” reads the Aug. 2, 2018, post.

Shortly after the dissolution in 2018, both parties agreed to arbitration with McCurine, a Rhodes scholar, Harvard Law School graduate and retired federal magistrate judge, to help resolve the dispute. Under the agreement, McCurine held exclusive control over the partnership’s assets, prohibiting either party from taking any action on behalf of the firm without his written authority.

But shortly after arbitration began, Peters frequently attempted to hamstring the process by filing for bankruptcy on three occasions (automatically halting all legal actions, including arbitration and depositions), destroying critical evidence by deleting employee email accounts and financial records, and refusing to appear for depositions, identify witnesses or provide exhibits, per court records.

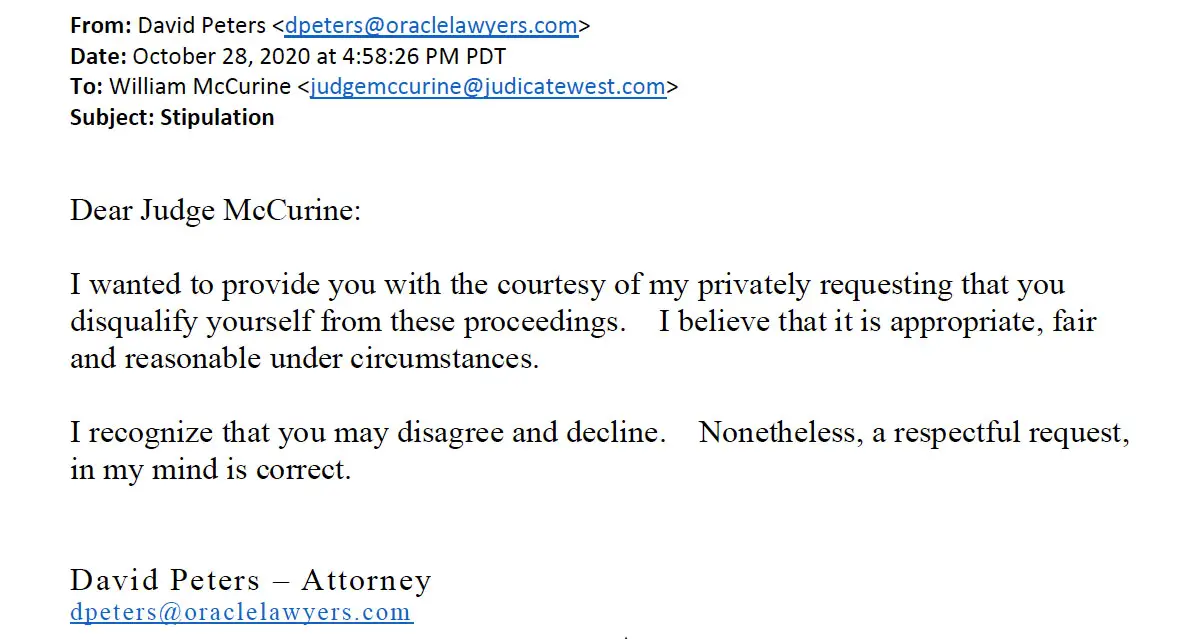

Throughout the arbitration, Peters launched personal attacks against the individuals involved in the dispute resolution process, legal filings show. Peters even privately emailed McCurine to request that he remove himself as arbitrator and filed an unsuccessful motion with Judicate West, a private firm in San Diego, seeking to disqualify him for alleged bias.

Eventually, McCurine issued a civil harassment restraining order against Peters based on multiple emails he sent to opposing counsel containing “disrespectful, unprofessional, and threatening language, which rise to the level of civil harassment.”

The petitioners further accused Peters of filing “bundles” of documents, declarations and pleadings that were “excessively long, totally unsupported, largely unintelligible, blatantly perjured (continuously), belligerent, and containing vitriolic and threatening language.”

Over the past five years, Peters initiated a total of four legal actions against his former partners, including arbitration, in what his opponents called “bad faith” attempts to harass petitioners and their interests and “obtain rulings inconsistent with rulings in the arbitration proceeding.” Peters also filed a cross-complaint against the arbitrator’s court-appointed attorney, Michael Breslauer, in a federal lawsuit originally brought against Peters by the firm’s malpractice insurance carrier.

But Peters’ attempts to gum up the works backfired in nearly every instance, according to court records.

A U.S. Bankruptcy Court judge sanctioned Peters $137,000 for improperly filing for bankruptcy on behalf of the partnership, a violation of the arbitrator’s order just days before his scheduled deposition.

In response to Peters’ destruction of evidence and refusal to participate in discovery, McCurine sanctioned him with an irrebuttable presumption — a legal inference that cannot be overcome by additional evidence or argument — that he had “misappropriated partnership funds.”

McCurine also handed down sanctions prohibiting Peters from calling his own witnesses to defend against his former partners’ allegations.

“It appears that (Peters) has done nothing to prepare for the arbitration,” McCurine wrote. “Rather, he has spent inordinate resources and time to prevent the arbitration from proceeding. Because of all the foregoing, his claims against respondents are hereby stricken in their entirety.”

Regardless of the severe sanctions, McCurine ruled that McCormick, Smith, Lakin, and DeJardin had demonstrated “thorough, detailed, and convincing documentary and testimonial evidence” that Peters had embezzled money from the firm and breached a buyout agreement by refusing to retire before Dec. 31, 2018.

‘Fleece the firm’

From September 2016 through 2018 (the period Peters, McCormick, Smith, Lakin and DeJardin were partners together at Peters & Freedman), Peters was the firm’s managing partner, “exercising total control over the firm’s finances.” As a habitual gambler, Peters repeatedly transferred partnership funds to his personal accounts to help cover his personal gambling losses, per court records.

Rich Holstrom, a forensic accountant, conducted an exhaustive accounting of Peters’ illicit financial activities, which was submitted as evidence to the court and later cited in McCurine’s arbitration ruling.

Holstrom “showed in graphic detail” the nexus between “Peters’ embezzlement and his gambling habit,” including $408,559 in cash advances on the firm’s credit card at casinos.

According to Holstrom’s report, Peters embezzled more than $2 million from one of the firm’s construction defect settlement funds in September 2018, all of which was lost gambling over four days shortly before the firm’s dissolution. Peters also misappropriated $4,449,480 from another construction defect settlement fund, depositing the money into a personal account without his partners’ knowledge.

Holstrom’s investigation also showed that Peters spent approximately $831,468 of partnership funds “to pay his personal credit card and lifestyle expenses” — two vehicles, gambling trips, unreported cash withdrawals and kickbacks to nonlawyers — charges that were never reimbursed to the firm.

“The evidence was incontrovertible that Peters regularly used partnership funds to gamble in Las Vegas or Native American casinos,” McCurine wrote in his arbitration ruling. “He did not do this once but did it repeatedly. The evidence established that Peters withheld distributions from his partners in order to fund his gambling activities, cover his gambling losses, and maintain his lavish lifestyle.”

“(Peters) deliberately kept his other partners in the dark” about the firm’s finances “so that he could fleece the firm to his own ends,” often employing “oppressive conduct to prevent the partners from pressing to review the firm’s finances,” including bullying, threats, intimidation, and demeaning staff and partners,” McCurine wrote.

The Coast News will continue to report this developing story.