UPDATE: A judge has dismissed a federal housing discrimination lawsuit mentioned below. However, the status of the case does not change the potential violations in this story.

ENCINITAS — A designated affordable home in Cardiff-by-the-Sea was sold to an investor and entered third-party escrow two weeks before the developer was authorized to begin advertising the house for sale, raising serious doubts about whether the home was purchased legitimately under the terms of the city’s affordable housing agreement.

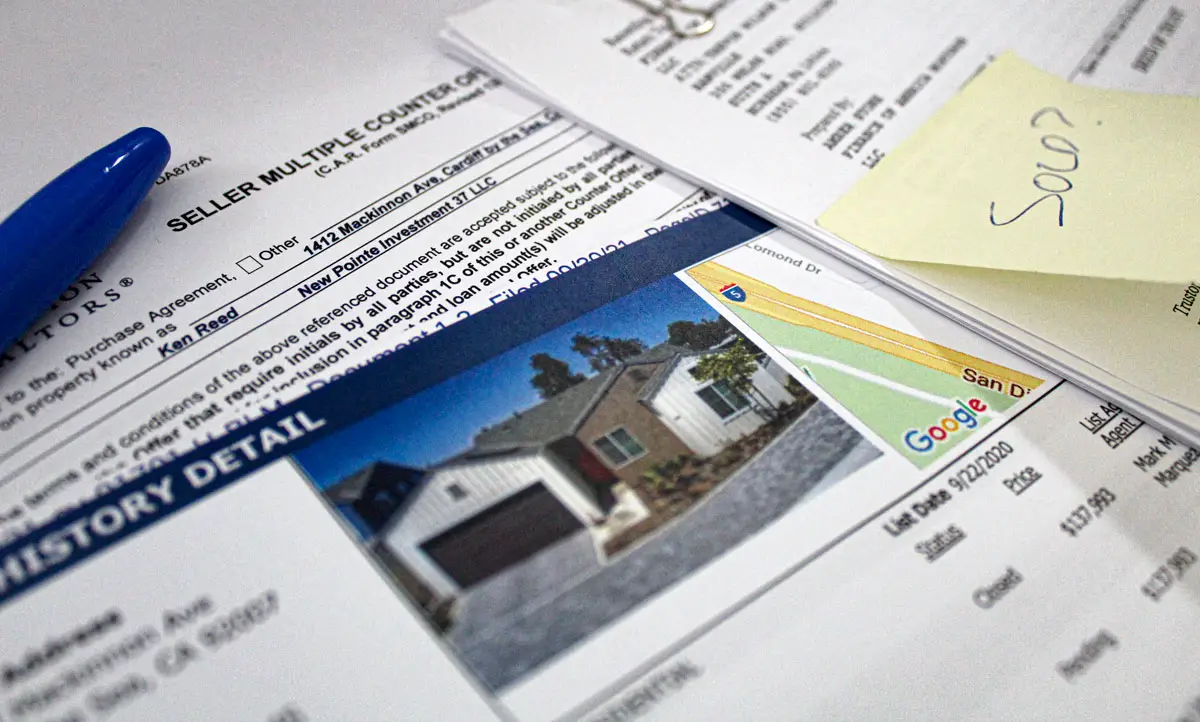

After first notifying the city of its intent to sell the home via email on Aug. 12, 2020, Kenneth Reed, a mortgage originator at Finance of America Mortgage, accepted a seller counteroffer from developer New Pointe Investment on Sept. 30, 2020, to purchase the affordable home at 1412 Mackinnon, according to financial records and emails obtained by The Coast News via public records request.

The Mackinnon property is one of two affordable homes at the center of a federal lawsuit alleging discriminatory and unlawful housing practices in Encinitas.

Under the city’s affordable housing agreement, New Pointe had approximately two weeks remaining of a mandatory 60-day waiting period before it was permitted to start advertising the sale of the home, much less locking in a buyer.

“Owner shall provide City with notice not less than 60 days prior to advertising the availability of the unit of their intent to rent or sell the unit,” the agreement states.

A “seller multiple counter offer” is a real estate tool allowing sellers to counter more than one offer to buy a property at a time. Once a buyer has signed and accepted the counter-proposal, the seller must sign the agreement to bind the contract.

After Reed accepted the counteroffer, Scot Sandstrom, founder and president of New Pointe and former president of the San Diego chapter of the Building Industry of America, signed the document on Oct. 2, 2020, ratifying the cash deal and sending the property into a seven-day escrow holding account at First American Title.

The City of Encinitas subsequently approved the sale to Reed on October 15, 2020, per city records, the same day New Pointe requested approval.

James Crosby, attorney for Reed, told The Coast News he had no comment for this story. The Coast News left a message for Timothy Hutton, attorney for New Pointe, but did not receive a response before publication.

New Pointe also ran advertisements for the Mackinnon home in the San Diego Union-Tribune as early as Sept. 13, 2020, just halfway through the two-month mandatory hiatus and in another apparent violation of regulatory guidelines.

“There is a 55-year deed restriction on the property, and all buyers are encouraged to do their own due diligence and comply with the City of Encinitas Affordable Housing Program regulations and requirements,” the advertisement reads.

The purchase agreement also discloses the commission rates for agents involved in the sale. Susana Marquez, Reed’s agent in the sale, is also the wife and business associate of Mark Marquez, owner of Marcor Ventures and New Pointe’s listing agent for the property.

According to the counteroffer form, the “buyer will pay all recurring and non-recurring closing costs, including real estate commissions, fees, and taxes.” The total real estate commissions were 3% to the listing agent (Mark Marquez) and 3% to the buyer agent (Susana Marquez).

By selling to Reed, Marquez’s agency, under parent brokerage firm Pacific Sotheby’s International, earned double commissions on the sale, instead of just 3% if New Pointe was to accept an offer from an unknown low-income applicant.

Jane Rheinheimer, legal counsel for Marquez, Marcor Ventures and Pacific Sotheby’s, did not wish to comment on this story.

Already sold?

After entering into an affordable housing regulatory agreement with the City of Encinitas in 2017, New Pointe hired real estate broker Mark Marquez to market and sell the affordable home at 1412 Mackinnon on its behalf as part of a residential ownership development.

According to public records obtained by The Coast News, Marquez’s team sent an email to the city on Aug. 12, 2020, with a list of questions, inquiring whether they could “sell to a non-qualified household for cash as an investment opportunity.”

Cindy Schubert, the city’s development program assistant, confirmed New Pointe might sell to a non-qualified buyer.

A couple of hours later, at 3:24 p.m. on Aug. 12, 2020, Schubert writes an email to inform Mark Marquez the city has not received a mandatory 60-day notice of intent to sell the Mackinnon home, despite the property being temporarily listed the day before for $20,000 below the approved sale price, according to court filings.

“Just to clarify, the City has never received notice of intent to sell this property and has not approved a sales price,” Schubert wrote in the email obtained through a public records request.

Mark Marquez responded four minutes later, asking, “Is there a reason for the 60 days, or can it be sooner once the city approves?” The Coast News could not locate the city’s response to this question in the provided records.

If Mark Marquez gave notice of intent to sell the home at the very earliest on Aug. 12, 2020, but sold the house to Reed in a written contract on Oct. 2, 2020, New Pointe failed to give the required 60 days’ notice in violation of regulatory agreement guidelines.

Following the email correspondence between the city and Marquez, the Mackinnon listing was pulled from MLS and reposted for $137,993 on Sept. 15, 2020, according to the listing exhibit in court documents. The home was later listed as “under contract” at 12:50 p.m. on Sept. 26, 2020, roughly four hours before the application window officially closed at 5 p.m.

Based on the dates and times of the listing, the affordable home was already under a sales contract with Reed several hours before the application period for potential buyers was closed.

The Coast News requested a comment from the City of Encinitas on this matter and will update the story with any provided remarks.

Relationships

Victor Spayde, Reed’s associate at Finance of America’s office in San Diego, was hired by New Pointe as the preferred lender for the Mackinnon property. Spayde was responsible for qualifying candidates to purchase the property.

According to the complaint, Spayde allegedly discriminated against a very low-income single mother, Leah Sorenson, who is also a plaintiff in the lawsuit, during the qualification process by ignoring her requests seeking qualification for the sale, enabling “his co-worker Kenneth Reed, a male investor to purchase the designated affordable home.”

While the nature of Reed and Spayde’s alleged “pre-existing relationship” as co-workers at Finance of America has not yet been determined, Finance of America has posted at least one photo depicting both Reed and Spayde standing together and smiling for the camera.

In the lawsuit, Reed’s employer, Finance of America, argued that it was not responsible for its employee’s allegedly unlawful actions since Reed did not finance the purchase of the Mackinnon home through the Texas-based lending company.

And indeed, city records show Reed paid cash for the Mackinnon home.

However, according to San Diego County Assessor’s Office records, approximately five months later, on March 15, 2021, Reed refinanced the home with his employer, Finance of America.

Attorneys for Marquez, Marcor Ventures and Pacific Sotheby’s have since filed a motion stating that under the “Developer Alternative Compliance Option” in the Encinitas Municipal Code, “the affordable housing requirement may be satisfied by providing 15% of the dwelling units in the residential development at an affordable rent to low-income households” or 10% to very-low-income households.

But the plaintiffs point out that “once the developer chose to sell the home, it had to be to a very-low-income household. The section cited by Defendants does not allow the seller to sell to an investor, as they now argue. It actually undercuts their argument altogether.”

The Coast News attempted to reach the plaintiffs’ counsel Anna Hysell regarding this story.

“This is very interesting, but we have no comment at this time,” Hysell said.

Lease or shield?

In a recent motion to dismiss, New Pointe claimed it could not have discriminated against low-income housing applicants because “they had a legitimate business interest to sell (the Mackinnon home) to an investor because a tenant was living in the home at the time of the sale.”

New Pointe stated that on the listing date of Sept. 15, 2020, a tenant was residing in the home through Aug. 31, 2021. To honor the occupant’s year-long lease agreement, New Pointe claims they could not have sold the home to a “non-investor” who intended to live in the house.

The city’s affordable housing agreement requires New Pointe to “provide the city with notice of not less than 60 days before advertising the availability” of the home, which includes listing the property for sale.

According to court exhibits, there is an earlier listing for the MacKinnon home for $119,000 on Aug. 11, 2020, more than four weeks before the official list date in mid-September.

If following this 60-day requirement, New Pointe would have supposedly first decided to sell the home in June 2020 — without a tenant or lease agreement precluding the firm from selling the home to a low-income “non-investor” buyer.

Additionally, Encinitas Municipal Code requires that “any rent regulatory agreement shall include provisions to allow for the sale of the affordable units and relocation benefits for tenants of the affordable units if the owner of the ownership residential development later determines to offer any affordable units in the residential development for sale.”

Under this requirement, New Pointe was obligated to relocate the tenant before selling the home. Instead, according to the listing, the firm negotiated a new lease with the tenants in Aug. 2020, just days before the house was listed for sale.

The current tenants of the Mackinnon home, a very-low-income family who signed the lease agreement with New Pointe days before it was sold to Reed, told The Coast News they were never offered an opportunity from either New Pointe or Marquez to purchase the home.

This raises the question of why New Pointe would sign a new lease with the same tenant if the company was obligated to move them out before selling the home. The complaint alleges New Pointe used the lease renewal as a “shield” to defend its decision to sell to an investor over a qualified very-low-income applicant.

Rent or own?

Several of the defendants, including the City of Encinitas, argued in recent court filings that state and local laws permit a developer (e.g., New Pointe) to sell an affordable home to a non-qualified investor, as long as the buyer rents the unit to a qualified low-income tenant for 55 years.

In the latest filing on behalf of the City of Encinitas, attorney Krista MacNevin Jee of Jones Mayer (the same private law firm as Tarquin Preziosi, the new city attorney for Encinitas), argued the city has no legal obligation under California’s Density Bonus Laws to ensure low-income prospective buyers have access to affordable homeownership, just so long as there are affordable rental units available.

The city also maintains that all rent or sale decisions of affordable units are those of the developer, not the city, despite what the plaintiffs have pointed out in the city’s municipal code.

“Plaintiffs seem to claim that the only, or some paramount, purpose of affordable housing, whether under State law or the City’s Municipal Code, is for homeownership, but this is incorrect,” the city argues. “The fact that all low-income individuals may, in some instances, have rental housing available to them instead of sale units is not a decision of the City, nor is it discriminatory.

“Implicit in Plaintiffs’ claims is the unsupportable notion that the affirmative providing of affordable housing is somehow discriminatory merely because it does not provide for sale affordable housing. Their claims assume, without any basis in fact or law, that homeownership is somehow always superior to rental.”

The city’s argument mirrors the remarks of Roy Sapa’u, the city’s director of development services, in a Sept. 2021 interview with The Coast News, explaining the city’s affordable housing agreements were drafted based on the city attorney’s “interpretation” of applicable housing laws.

“Based on the city attorney’s interpretation of the law, as long as that individual, investor, or nonprofit group is committed to renting the unit to a low-income household, then that meets the intent of the law,” Sapa’u said.

But even if the city’s interpretation of the law allows for both the rental and sale of affordable units, the number of low-income buyers who successfully purchased affordable homes in Encinitas is strikingly low.

According to public records included in the complaint, the city reported that 22 single-family affordable homes were sold under the density bonus law in Encinitas between 1995 and 2017. Of those homes, just six (27%) were sold to low-income or very-low-income households, while the remaining 73% were sold to investor buyers.

In court filings, the city defends this disparity by arguing there is no discriminatory conduct since all investor-owned affordable homes were subsequently rented to low-income residents.

However, both properties at Portola and Mackinnon were listed as residential ownership developments, which under city statute requires at least 15% of homes to be sold, not rented, to low-income buyers, or at least 10% sold to very-low-income buyers.

Woodbridge Pacific Group, the developer of the low-income property on Portola Road as part of the Loden at Olivenhain development, ran city-approved advertisements in The Coast News’ print editions on March 5 and March 12, listing the home as an opportunity for “affordable homeownership.”

“Tucked within a private cul-de-sac within the beautiful enclave of Loden Olivenhain, Woodbridge Pacific Group is offering a new single-story home through the Affordable Home Ownership Program,” the ad reads. “This beautiful three-bedroom, two-bath, two-car garage home is reserved for affordable homeownership.”

The ad for the Mackinnon property in the San Diego Union-Tribune was also listed as an “affordable home for sale.”

Indeed, the plaintiffs, all of whom are very low-income individuals, including an Asian American woman and her Hispanic husband, who live with their children, have publicly stated they were attempting to purchase, not rent, these homes under the city’s affordable housing program.

According to the complaint, the city’s affordable housing agreements allowing developers to sell to a non-qualified investor violate its ordinances.

In a recent filing, the plaintiffs further denounced the city’s suggestion that merely providing rental units to low-income residents satisfies its obligations to further affordable housing under the law.

“The idea that City defends the discriminatory sale of an affordable home with, ‘Yes, but we rent to minorities’ is alarming and evidences discriminatory conduct,” the filing reads. “Is City suggesting renting should be sufficient for minorities? This rationale explicitly demonstrates discrimination by City and its developers toward protected classes that they effectively should only be steered to rent.”

The Fair Housing Act prohibits discriminatory conduct, also known as “steering,” such as “refusing to rent or sell, negotiate or otherwise make housing unavailable” to individuals based on race, color, religion, gender identity and familial status (e.g., number of children, single mother).

Additionally, the California Supreme Court has held that traditional protections are not necessarily limited to these characteristics under the state’s Unruh Civil Rights Act. The law is “meant to cover all arbitrary and intentional discrimination by a business establishment, including in housing and lending transactions, on the basis of personal characteristics,” according to the California Department of Real Estate.

Attorneys for New Pointe argued that a very low-income buyer couldn’t plausibly be looking to purchase the home as a rental investment.

“Plaintiffs ask the Court to suspend reason and simultaneously entertain the alternative conclusions that, on the one hand, (plaintiff) is a very low-income person in need of affordable housing for herself and her kids, but she also could have purchased 1412 Mackinnon as an investment property with a very low-income tenant and all of the responsibilities that come with maintaining a home as a landlord.”

But in a motion to strike, the plaintiffs issued a scathing retort, skewering the investment firm’s presumptive and “discriminatory” remarks.

“The fact that (New Pointe) questions how a single mom could possibly figure out how to purchase an affordable home and manage it as a rental is disturbing, and on its face discriminatory,” the plaintiff’s response reads. “A very low-income resident of Encinitas does not necessarily mean destitute and incompetent.

“…Why can’t (New Pointe) remotely contemplate that Sorenson, a single mother, could not own the house and collect those rent checks, but Reed, a married male, can? The answer is simple – discriminatory bias.”

2 comments

Another Blakespear fiasco. She is a soul less politician who couldn’t care less about anything other than her hopefully short political career.

If you see the name Catherine Blakespear on your ballot for State Senate vote for someone else.

Joe Kerr and Matt Gunderson are actual humans with a pulse who care about people.

Great article on the City corruption. This needs to be reported to the DOJ. They need to look into the last two years of contracts.

Comments are closed.