For years, illegal short-term rentals in Encinitas have created headaches for neighboring homeowners and law-abiding rental hosts while leaving thousands, if not millions, of dollars on the table in unpaid tax revenue.

Each short-term rental operating in Encinitas, owner-occupied and non-hosted, short- and long-term, is required to obtain a city-issued permit. Once licensed, homeowners must pay annual fees and a transient occupancy tax of 10% of their earnings every quarter.

Some residents who have attempted to report illegal short-term rentals popping up in their neighborhoods feel the city is not effectively enforcing the laws on its books.

Teyo Branwell, 47, has been a homeowner in New Encinitas for more than a decade. In recent years, Branwell said his neighborhood has experienced countless instances of noisy gatherings, late-night disturbances, parking violations, speeding vehicles, and garbage left in the street by out-of-town guests staying in illegal vacation rentals.

Despite reporting these issues to the city’s Code Enforcement, Branwell said some of the hosts continued to illegally rent to guests for months. Some were even later approved for a permit after the city was notified of their unlicensed operations.

“The whole thing is crazy,” Branwell told The Coast News. “I’ve sent countless emails. I know I’m not the only one that’s frustrated by this whole process.”

Branwell has reported his family being awoken at 5 a.m. to find the guest of an unregistered rental home passed out in a running vehicle blocking his driveway.

On another occasion, visitors at the same unit didn’t use the trash receptacles and instead threw their garbage bags in the street for a week, attracting birds that ripped them open and spread trash across the neighborhood. Branwell said neighboring property owners called the sheriff multiple times before the home was eventually removed from online listings.

In June, Branwell notified the city about another nearby home operating with an expired permit. The property had also received complaints about offsite parking, excessive noise and a failure to display their permit on the exterior of the home in accordance with city requirements.

According to public records provided to The Coast News, when the city warned the rental host to stop all short-term rental activity until the permit was renewed and active, the homeowner said they felt obligated to honor their guests’ previous bookings.

“Yes, I’m still operating because I simply can’t afford not to! And the thought of disappointing so many guests would be a tragedy,” the rental host wrote in an Aug. 10 email. “The world is upside down right now, so everyone deserves a break and to enjoy time with family at my property. Who am I to deny them that? …I feel like I have been prosecuted for doing nothing wrong — all because of a nasty neighbor.”

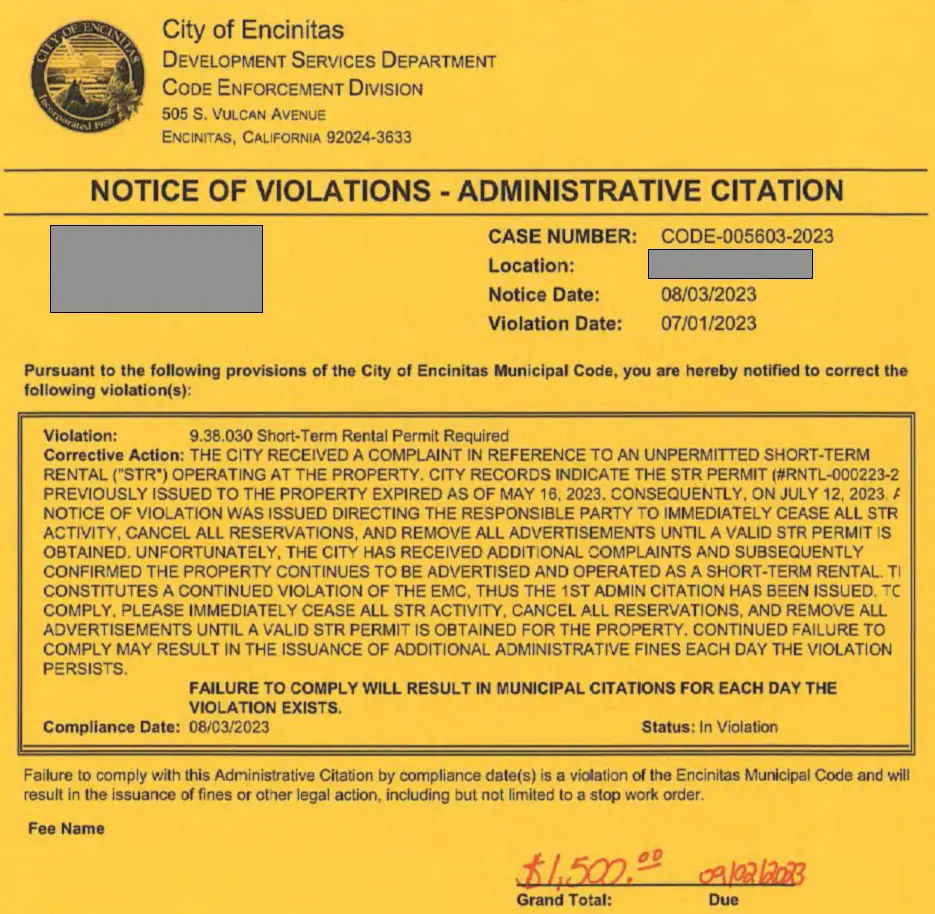

Over two months, the city had numerous phone and email correspondences with the rental host, conducted six home inspections, issued multiple written warnings, and served two administrative citations totaling $4,500, during which time the owner reportedly continued renting unabated.

The city eventually closed the case after approving their renewal application in August.

In total, Branwell has documented and reported over a dozen unregistered short-term rentals in the neighborhoods of New Encinitas.

“At the end of the day, I’m all for somebody doing a side hustle,” Branwell said. “But I didn’t buy my slice of paradise to be next to a Motel 6. The permit is intended to safeguard against parking, noise and trash. So, when they don’t have a permit, they just run wild.”

Bryant Jemison, the city’s code enforcement supervisor, said the city takes Branwell’s complaints seriously and has diligently worked to address the issues brought to the department’s attention.

“The city has received several citizen complaints from Mr. Branwell. All have been addressed with the utmost urgency,” Jemison wrote in an email to The Coast News.

According to Jemison, the complaint process begins once a resident submits a valid Citizen Complaint. Within three days of receiving a complaint, a code enforcement officer generates a code case, although the timeline can vary depending on the department’s caseload, Jemison said.

The assigned code officer will then investigate to confirm the violation. If verified, the city will issue a notice of violation or warning, directing the individual to take corrective action. Failure to comply may result in fines ranging from $1,500 to $5,000 per infraction for repeat offenders.

But Branwell and other neighbors question why the city continues to renew permits for repeat offenders who don’t play by the rules, expending incredible amounts of manpower and city resources simply to obtain compliance.

‘They don’t make it easy’

Among registered hosts of owner-occupied, single-room rental units who pay their taxes and jump through all the bureaucratic hoops, some feel the city’s one-size-fits-all system doesn’t work.

Kim, who asked not to publish her last name out of fear of reprisal due to her pending short-term rental permit application, has operated a rental space since 2017 when a car accident left her disabled.

The supplemental income provided a much-needed lift for her family when paying the bills. In 2021, the city changed its short-term rental requirements and nearly tripled the annual renewal fee from $150 to $425, regardless of the home’s size or number of rooms available to rent.

“We are paying the same amount as someone renting an entire house — $425 a year for a single room,” Kim said. “I’m okay with the rules. I believe people should have permits and be monitored to some degree. I would be upset if my neighbor had an Airbnb and parties were going on all the time. But there is a difference between renting out one room and staying on your property and renting out the entire house for $1000 per night.”

After four years without any issues or complaints, Kim’s home underwent a city inspection. Subsequently, she was required to install a security system with alarms on her pool, hot tub, both exterior gates, and sliding glass doors — portions of the house that weren’t even accessible to the guests — at an additional cost of $600.

“They told us we had to shut down until everything was up to code,” Kim said. “I can’t shut down because I have people booked.”

All registered hosts are required to mail their applications, forms and TOT payments to the city. The city does allow TOT forms to be sent electronically via email, but the user must then make a credit or debit card payment over the phone for a 3.59% fee.

“They don’t make it easy,” Kim said.

While navigating the red tape and taxes, Kim said she often wonders about the illegal rentals that aren’t paying their fair share, reaping the benefits of untaxed supplemental income in an unregulated dwelling.

“I can see them on Airbnb,” Kim said. “I’m competing with these people, but I’m paying taxes and annual fees while the city is sitting there allowing these units without permits. How is that fair to all of us who have been playing by the rules, paying the taxes and fees every year?”

Lost TOT

In 2018, the city hired San Francisco-based Host Compliance to help identify and monitor short-term rental properties and activity in Encinitas. Based on its initial analysis, Host Compliance found 1,123 short-term rental listings in the city advertised on more than 50 websites, 800 of which were unique rentals.

In April 2022, the city reported significantly fewer rentals overall — just 437 licensed rentals, 90 applications under review, and 94 without permits — although how and why the number of listings declined so drastically over a four-year period remains unclear.

Currently, there are 358 short-term rental permits, 67 applications under review, and between 150 and 200 vacation rentals operating without a valid permit, according to Jemison and city staff.

AirDNA, a website analyzing short-term rental data worldwide on Airbnb and Vrbo, shows 596 active rentals in Encinitas as of July, 91% of which are entire home rentals.

According to Kristina Sprindyte, senior director of communications at AirDNA, the flexible nature of the short-term rental market — rentals go online and offline from month to month — makes it difficult to pinpoint an exact number at any given point in time.

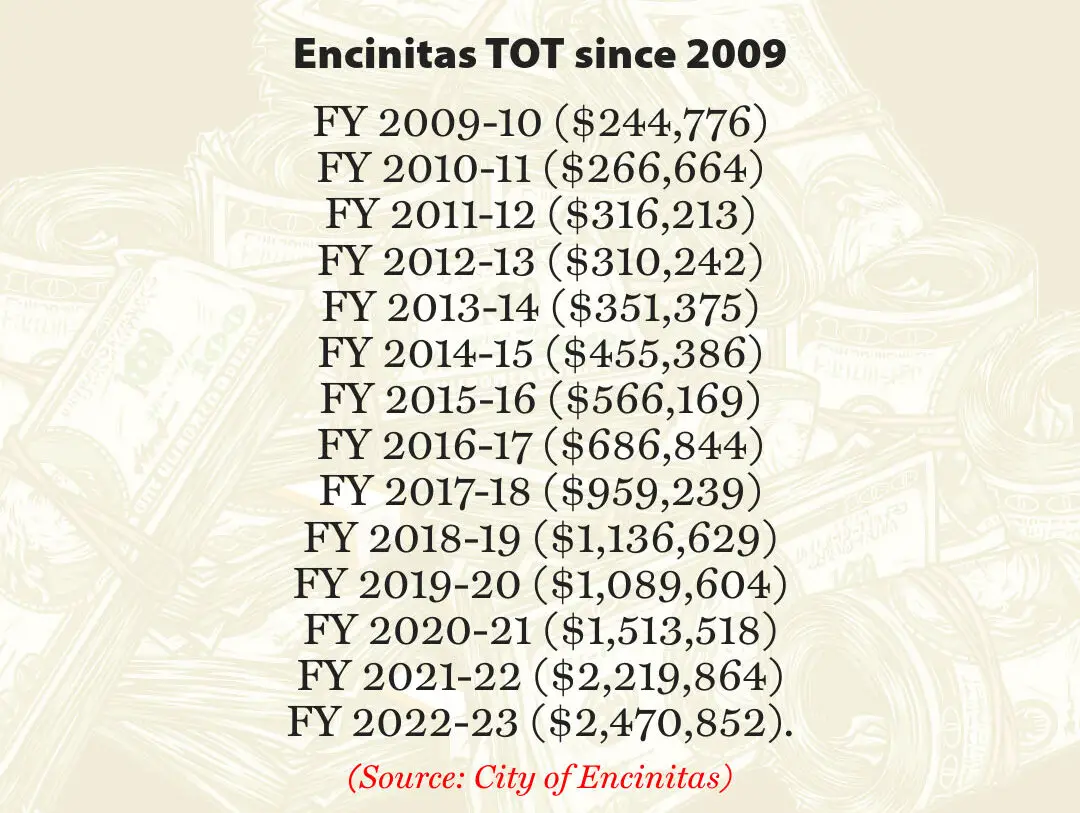

What can be calculated is the city’s annual TOT revenue, which has increased nearly every year since 2009. Most recently, the city reported $2,470,852 in TOT revenue for the fiscal year 2022–23.

According to AirDNA, the average non-hosted home rental in Encinitas earns $75,852 in annual taxable revenue, generating $7,585 in transient occupancy taxes.

If 200 homes are operating illegally in the city, the city is losing $1.5 million in potential tax revenue every year. And that’s just Airbnb and Vrbo.

What if, as Host Compliance previously reported, there are 1,000 vacation homes total in Encinitas across various platforms? Taking into account the 425 registered units currently identified by city staff, that’s nearly $3.9 million in unrealized tax revenue, 2% of which would be going to citywide beach sand replenishment and stabilization projects.

The question becomes, “How much money is the city willing to walk away from?”

“If the city were to enforce the code and get the illegally operating rentals into compliance, the revenue would be astronomical,” Branwell said. “Why don’t you enforce what you have right now?”

Branwell also questioned if the city recoups TOT for time a rental unit was operating with an expired permit. According to Jemison, it’s standard procedure for the city to audit rental properties operating without a permit to determine retroactive hotel taxes.

However, it’s unclear how often these audits are done, how long they take to complete and how much the city has recouped from this process.

Santa Monica

The solution to enforcement could be found in the city of Santa Monica, which has for decades banned all short-term rentals in the city. In 2015, the city adopted an ordinance easing the ban, allowing licensed hosts to rent a room within their home to visitors for no more than 31 days if the resident and guest were both present in the home.

The ordinance also penalized online platforms like Airbnb and Homeaway (Vrbo) for booking short-term vacation rentals of unlicensed properties in Santa Monica, even slapping the company with fines for non-compliance. In 2017, the city took it another step further, amending the ordinance to prohibit these online rental sites from collecting payments from unlicensed hosts.

After legal wrangling, the city signed an agreement with Airbnb requiring all its hosts to register with the city and obtain a license number and business permit. Customers would also be charged a 14% hotel tax and an additional $2 per night to help pay for affordable housing in Santa Monica.

“Say I’m busted for not having a permit, and the city shuts down my Airbnb and hits me with a fine,” Kim said. “What’s to stop me from getting on Airbnb and going ahead and renting the room anyway? The only thing that could stop me is if they required a permit to list on Airbnb.”

The city requires residents to submit valid Citizen Complaint forms for any potential municipal code violations. Forms can be found on the city’s website: https://www.encinitasca.gov/government/departments/development-services/code-enforcement/filing-a-complaint/citizen-complaint-form.

1 comment

Air BnB should only be allowed in owner occupied homes. Period.